Why Most Marketers Stay Broke (Even After Making Money)

The online business world is full of people making income, but very few build wealth. Here's how to fix that.

The Truth Hurts (But It’ll Save You Money)

Building a business online can be exciting, overwhelming, and intimidating all at once.

Sure, it’s cheaper to start online than rent a storefront, but those costs can still sneak up fast.

Maybe you’ve made a few bucks—sold a product, landed an affiliate commission, or picked up a client.

You’re getting those Stripe alerts. It feels like progress.

But somehow, your wallet still feels light.

You’re not alone. Most marketers know how to make money… few know how to keep it.

This isn’t just another blog post. This is a field manual for online entrepreneurs who want their bank account to reflect their hustle.

Step 1: What Stage Are You In?

“You can’t plan smart if you don’t know where you’re standing.”

Your money moves should match your business stage.

Beginner

You’ve made some sales. Bought too many courses. Trying everything at once.

Money rule: Spend as little as possible. Use free tools. Validate fast.

Intermediate

Clients or product sales are happening, but money’s still flying out.

Money rule: Create a real budget. Audit your subscriptions. Build a cash buffer.

Pro

Revenue is steady. Maybe you have a small team. But profit still isn’t where it should be.

Money rule: Track everything. Cut waste. Delegate smart.

Reminder: Don’t act like a 7-figure business if you’re not profitable yet. That’s dashboard vanity.

Step 2: Budget Before You Need To

Most treat budgeting like a fire extinguisher—only useful when things are already burning.

Get ahead of it:

List your income sources: freelancing, sales, affiliate earnings

List all expenses: fixed (email platform, domains) and variable (ads, courses)

Find the leaks:

That $12 subscription you forgot? That’s $72 in six months

Use tools like Notion, Google Sheets, or any app you’ll actually use

Awareness creates control. Control creates real progress.

Step 3: Build an Emergency Fund

“When Stripe freezes your account or a client ghosts you, your buffer buys you time.”

Start with $1,000. Build up to 3–6 months of core expenses. Keep it separate. Make it hard to “accidentally dip into.”

An emergency fund won’t make you rich, but it keeps you from crashing.

Step 4: Spend While Building, Not Dreaming

Buying tools for ideas you haven’t started yet? That’s budget suicide.

Ask yourself:

Am I working on something that requires this tool right now?

Will it make or save money in 30–60 days?

Is there a cheaper option?

If not, skip it or wishlist it.

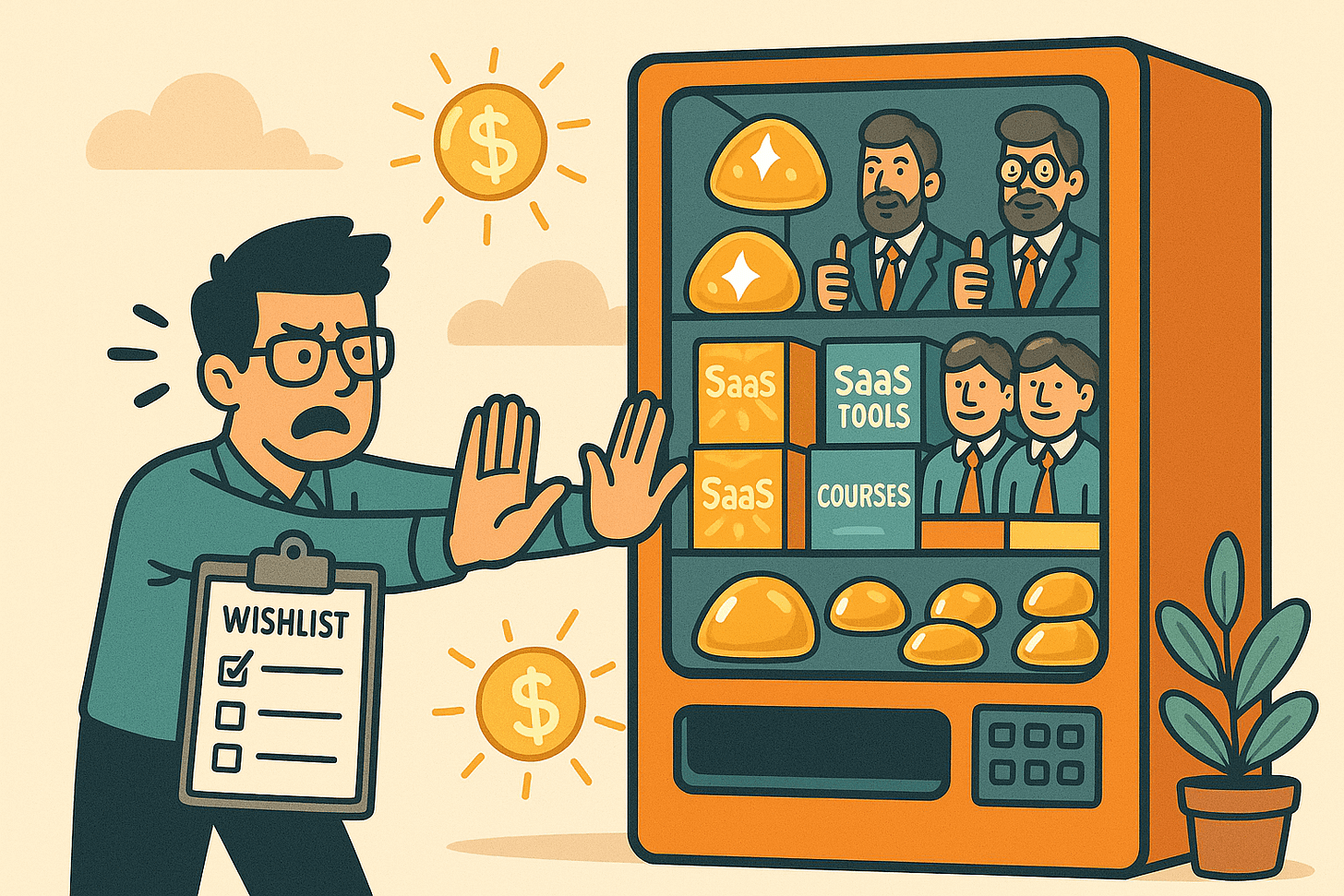

Step 5: Kill Shiny Object Syndrome (With Systems)

We’ve all done it: bought a flashy $297 course you never logged into.

Solution? The Wishlist Rule:

See something you want? Add it to your wishlist.

Revisit it in 30 days.

Still want it and you’ll use it? Buy it then.

You don’t build success by collecting. You build it by implementing.

Step 6: Cut Costs Without Starving Your Growth

Lean ≠ cheap. It means focused.

Use tools like:

Systeme.io (all-in-one business platform)

Canva (design)

Google Drive (docs & storage)

Notion (organization)

Stripe / PayPal (payments)

Cutting waste gives you margin to grow.

Note: I just showed you tools that pay affiliate commissions for sales—but there are no affiliate links in here. You’re welcome.

Cutting waste gives you margin to grow.

Step 7: Split Your Money Intentionally

“Every dollar needs a job.”

Use this basic formula:

50% → Reinvest in business

30% → Save or emergency fund

20% → Pay yourself

Use your 3-month income average to guide what’s realistic.

Step 8: Don’t Quit Too Soon

That one great month? It’s not a trend. Yet.

You’re ready to quit your day job when:

You consistently earn 2× your monthly expenses

You’ve saved 3–6 months of expenses

You have systems that create predictable income

Until then, treat your job like startup capital.

Jim Rohn nailed it:

“I’m working full-time on my job and part-time on my fortune.”

Step 9: Build Money Habits That Stick

Check in weekly:

What did I make?

What did I spend?

What worked?

What flopped?

Track monthly goals:

Increase profit margin

Cut tool costs

Build cash reserve

Forget perfect. Aim for consistent.

Final Word: Revenue is Flash. Profit is Freedom.

You can make $10K a month… and still be broke if $8K goes to expenses.

Profit gives you peace, growth, and options. That’s what you’re after.

Track your money. Build margin. Focus on freedom.

The best marketers don’t just earn—they keep what they make.

That’s real winning.

One Last Thing (My Shameless Ask)

If this helped you, I didn’t just hand you free tips — I gave you real tools I use myself.

Those tools all pay affiliate commissions. And I could’ve easily made $200 just by dropping my links in this post.

But I didn’t. On purpose.

Why? Because I want to earn your trust before I ever earn a commission.

So here’s my ask:

👉 Share this with a friend who needs it.

Post it. Text it. Drop it in a group chat. Help someone keep more of what they earn.

This post is free. But what it teaches? That’s worth way more than $200.

Thanks for reading,

Fred (GeezerWise)

📌 This was written by Fred Ferguson (GeezerWise). If it spoke to you, I’d love to hear back—just hit reply.

💭 Got a question, memory, or topic you'd like me to write a letter about? Hit reply and let me know—I won’t respond individually, but I may turn it into a future letter. Consider it a suggestion box for the soul.

💌 Know someone who’d appreciate this? Forward it or invite them to subscribe at www.geezerwise.com.

⚠️ If you see a message below about pledging support—that’s Substack’s way of letting readers chip in if they want. Totally optional but always appreciated if this work means something to you.

—Fred [GeezerWise]

#SmartMoneyMoves, #MarketingOnABudget, #GeezerWiseTips, #BootstrappingBusiness, #OnlineBusinessReality, #ProfitOverHype