💰 9 Financial Planning Tips for Online Marketers (You Know... So You Don’t End Up on GoFundMe)

GeezerWise Money Talk - Written by two-finger typer Fred Ferguson

Note to subscribers:

If you’re making money online but your wallet still feels empty, this one’s for you. I’ve seen plenty of digital hustlers crash and burn—not because they couldn’t earn, but because they couldn’t manage. Let’s fix that.

There’s something strange about the online marketing world: plenty of folks know how to make money… but not a damn clue how to keep it.

You’d be surprised how many big-earning marketers end up broke the minute life throws a curveball. Illness, burnout, a dip in traffic—and suddenly they’re crowdfunding their next medical bill.

Don’t let that be you.

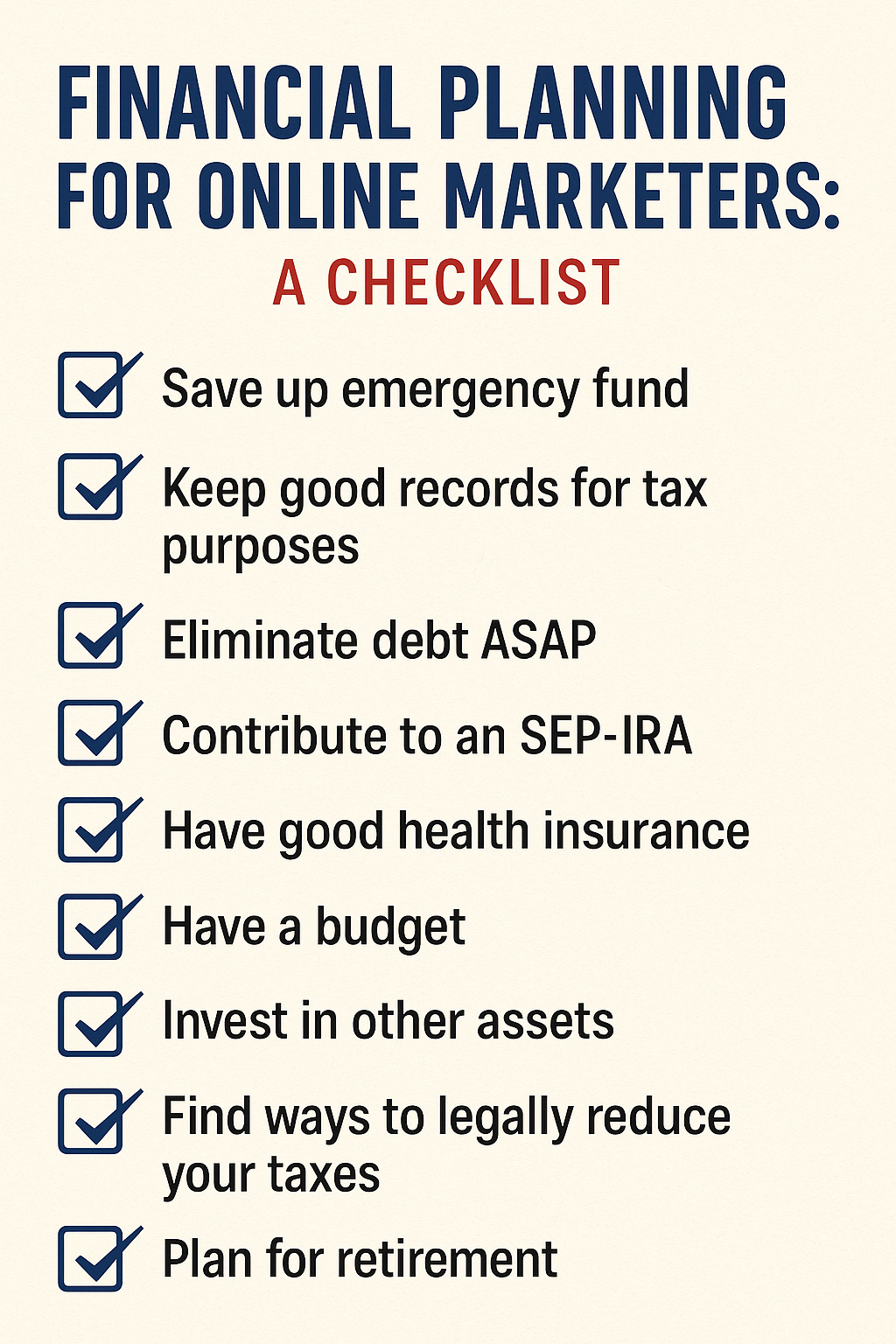

Here are 9 financial tips to help you keep your business stable, your life sane, and your future comfortable.

🛟 1. Build That Emergency Fund

Stuff happens. Sick days. Surgery. Server crashes. If your biz relies on you to show up, then you better have 3–6 months of living expenses stashed somewhere safe.

It’s not just a cushion—it’s your safety net.

📚 2. Track Your Money (The Taxman Sure Will)

Nobody’s keeping your books but you. Income. Expenses. Deductions. If you want to survive tax season with your sanity intact (and your backside covered), keep clean records.

And if you hire a CPA? Give ’em something tidy to work with.

💳 3. Kill Your Debt, Not Your Momentum

Making money online feels good. But paying off debt? That’s what freedom tastes like.

Get serious about clearing those credit cards, loans, and bills. No six-figure income is impressive if you owe most of it.

🧓 4. Set Up an SEP-IRA (Future You Will Thank You)

If you’re self-employed, this is one of the best ways to build a retirement nest egg and lower your taxable income.

Simple. Smart. And way better than waiting until you’re 67 and still chasing leads.

🏥 5. Get Health Insurance, Even if You’re “Healthy”

One hospital visit can wipe out years of savings.

Good coverage—medical and dental—might feel expensive now, but it’s cheap compared to a root canal or a night in the ER.

📊 6. Make a Budget (Then Actually Stick to It)

What’s coming in? What’s going out?

If you can’t answer that without opening five tabs and squinting at your bank app, it’s time for a budget.

Stop dropping thousands on “guru” courses you’ll never finish. Spend wisely. Scale slowly.

📈 7. Invest in More Than Just Funnels

Marketing money is great, but don’t park all your eggs in the digital basket.

Stocks. Real estate. Boring but powerful. That’s where real wealth starts to build.

🧾 8. Know the Legal Loopholes

Work from home? You may be sitting in a tax deduction.

Talk to a CPA. There are more ways to legally lower your taxes than most online marketers bother to learn.

🏖️ 9. Think Retirement Before It Sneaks Up on You

You won’t be young forever—and this whole “digital nomad” thing won’t feel as cool when your back goes out.

Plan now. Save now. So later, you’re not hustling at 73 just to pay rent.

Final thought from Fred:

Making money is just the first step. Keeping it, growing it, and planning for the long haul? That’s what separates the flash-in-the-pan marketers from the folks who actually retire rich.

If you’re in this game for the long run, start acting like it now. Smart money habits aren’t optional. They’re survival.

📌 This was written by Fred Ferguson (GeezerWise). If it spoke to you, I’d love to hear back—just hit reply.

💭 Got a question, memory, or topic you'd like me to write a letter about? Hit reply and let me know—I won’t respond individually, but I may turn it into a future letter. Consider it a suggestion box for the soul.

💌 Know someone who’d appreciate this? Forward it or invite them to subscribe at www.geezerwise.com.

⚠️ If you see a message below about pledging support—that’s Substack’s way of letting readers chip in if they want. Totally optional but always appreciated if this work means something to you.

—Fred [GeezerWise]